For a time horizon of around two years.

B&H Deuda FI

Gestión 0,30%

Depositaría 0,05%

For investors with a conservative profile and a horizon of around two years.

Our most conservative fund that invests only in fixed income.

B&H Debt FI invests exclusively in B&H Debt LUwhich selects a 100% investment grade fixed income portfolio whose average duration will not exceed three years.

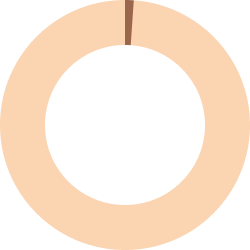

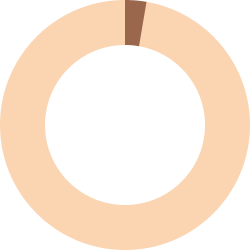

Composition of the BH Deuda FI portfolio

99% B&H Debt LU

1% Liquidity

B&H Debt LU Portfolio Composition

97% Bonds

3% Liquidity

Profitability from the start

Iboxx Euro Overall Total Return

B&H Deuda FI

Annual Return

| B&H DEUDA | Benchmark | Return Gap | |

|---|---|---|---|

| 2025 | 3,24% | 1,28% | 1,96% |

| 2024 | 5,61% | 2,51% | 3,10% |

| 2023 | 6,95% | 7,20% | -0,25% |

| 2022 | -2,34% | -17,22% | 14,88% |

| 2021 | 5,10% | -2,87% | 7,97% |

| 2020 | -0,64% | 2,23% | -2,87% |

Returns net of commissions.

Past performance is not indicative of future results.

Cumulative Return

| B&H DEUDA | Benchmark | Return Gap | |

|---|---|---|---|

| YTD | 0,78% | 1,68% | -0,90% |

| 1 Year | 3,44% | 2,61% | 0,83% |

| 3 Years | 15,78% | 12,43% | 3,35% |

| 5 Years | 19,31% | -6,92% | 26,23% |

| Launched Feb 2020 | 19,86% | -6,92% | 26,78% |

Cumulative returns based on actual data.

Returns net of commissions.

Past performance is not indicative of future results.

All documentation always up to date

Other funds

you may also be interested in

Performance of BH Renta Fija Fija Europa Sicav, merged with the B&H Bonds LU fund.

Performance of Pigmanort Sicav, merged with the B&H Flexible LU fund.

Performance of Rex Royal Blue Sicav, merged with the B&H Equity LU fund.

Our pension plan to prepare your retirement.