For a time horizon of at least 7 years.

B&H Equity LU

Gestión 0,81%

Éxito 7% sobre el beneficio

Depositaría 0,04%

For investors with a horizon of at least 7 years.

Our fund with the longest history.

B&H Equity invests in primarily U.S. and European equities, with the ability to invest in any continent. It prioritizes quality, easily understandable and reasonably priced businesses. The portfolio consists of about 30 to 40 companies with clear competitive advantages and without excessive concentration in any one company.

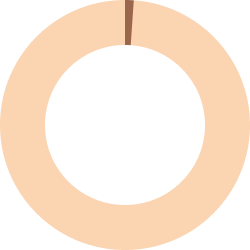

B&H Equity LU Portfolio Composition

99% Shares

1% Liquidity

Profitability from the start

MSCI World Total Return Net from 04/2019MSCI Europe Total Return Net until 03/2019

B&H Equity LU

Annual Return

| B&H EQUITY | Benchmark | Return Gap | |

|---|---|---|---|

| 2025 | -0,70% | 6,77% | -7,47% |

| 2024 | 10,96% | 26,60% | -15,64% |

| 2023 | 25,78% | 19,60% | 6,18% |

| 2022 | -24,55% | -12,78% | -11,77% |

| 2021 | 32,19% | 31,07% | 1,12% |

| 2020 | -0,50% | 6,30% | -6,80% |

| 2019 | 26,75% | 28,00% | -1,25% |

| 2018 | -17,19% | -9,87% | -7,32% |

| 2017 | 14,56% | 9,20% | 5,36% |

| 2016 | 8,37% | 3,02% | 5,35% |

| 2015 | 2,35% | 6,71% | -4,36% |

| 2014 | 8,24% | 6,44% | 1,80% |

| 2013 | 34,36% | 18,97% | 15,39% |

| 2012 | 17,90% | 16,70% | 1,20% |

| 2011 | -4,10% | -7,00% | 2,90% |

| 2010 | -2,90% | 9,40% | -12,30% |

| 2009 | 42,30% | 30,20% | 12,10% |

| 2008 | -38,80% | -42,80% | 4,00% |

| 2007 | 6,60% | 4,00% | 2,60% |

| 2006 | 24,00% | 18,50% | 5,50% |

| 2005 | 24,50% | 25,50% | -1,00% |

| 2004 | 11,70% | 6,30% | 5,40% |

Returns net of commissions.

Past performance is not indicative of future results.

Cumulative Return

| B&H EQUITY | Benchmark | Return Gap | |

|---|---|---|---|

| YTD | -0,35% | 2,96% | -3,31% |

| 1 Year | -4,72% | 8,08% | -12,80% |

| 3 Years | 24,51% | 57,78% | -33,27% |

| 5 Years | 34,09% | 85,88% | -51,79% |

| Launched Ago 2004 | 367,38% | 416,90% | -49,52% |

Cumulative performance based on actual data.

Returns net of fees.

Past performance is not indicative of future results.

Assumed returns of Rex Royal Blue Sicav, merged with the BH Equity LU fund.

All documentation always up to date

Other funds

you may also be interested in

Nuestro fondo de inversión en acciones con potencial de compañías de calidad a precios razonables.

Performance of our most conservative fund.

Performance of the SICAV BH Renta Fija, merged with the B&H Bonds fund.

Performance of the Pigmanort SICAV, merged with the B&H Flexible fund.

Nuestro plan de pensiones para preparar tu jubilación.