For a time horizon of at least four years.

B&H Flexible LU

Gestión 0,66%

Éxito 5% sobre el beneficio

Depositaría 0,04%

For investors with a horizon of at least four years.

The fund that combines our ideas with the greatest potential in fixed income and equities.

B&H Flexible LU has a track record of more than 15 years with returns typical of stock market investment but with very controlled volatility thanks to the active management of its fixed income and a careful calibration between assets, with a weight in equities that has historically ranged between 40% and 55% of the fund’s portfolio.

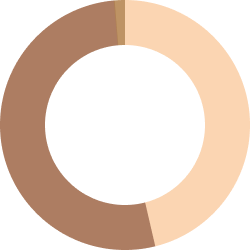

Composition of the B&H Flexible LU portfolio

43% Shares

55% Bonus

2% Liquidity

Profitability from the start

50% MSCI World net + 50% Bloomberg Euro Aggregate Corporate Bond from 04/2021 | 25% MSCI World Net + 75% Barclays Euro Aggregate Corporate Bond 5-10 Years until 03/2021

B&H Flexible LU

Annual Return

| B&H FLEXIBLE LU | Benchmark | Return Gap | |

|---|---|---|---|

| 2025 | 2,48% | 5,21% | -2,73% |

| 2024 | 9,60% | 15,34% | -5,74% |

| 2023 | 21,83% | 13,95% | 7,88% |

| 2022 | -16,90% | -12,85% | -4,05% |

| 2021 | 20,55% | 12,11% | 8,44% |

| 2020 | -0,75% | 4,00% | -4,75% |

| 2019 | 20,53% | 12,60% | 7,93% |

| 2018 | -10,28% | -3,90% | -6,38% |

| 2017 | 14,34% | 4,40% | 9,94% |

| 2016 | 6,61% | 4,20% | 2,41% |

| 2015 | 5,37% | 1,50% | 3,87% |

| 2014 | 1,81% | 7,80% | -5,99% |

| 2013 | 21,50% | 6,70% | 14,80% |

| 2012 | 23,20% | 14,40% | 8,80% |

| 2011 | -7,20% | -0,80% | -6,40% |

| 2010 | 9,20% | 4,20% | 5,00% |

Returns net of commissions.

Past performance is not indicative of future results.

Assumed returns of BH Pigmanort Sicav, merged with the BH Flexible LU fund.

Cumulative Return

| B&H FLEXIBLE LU | Benchmark | Return Gap | |

|---|---|---|---|

| YTD | 0,62% | 1,39% | -0,77% |

| 1 Year | 1,93% | 7,06% | -5,13% |

| 3 Years | 24,95% | 43,47% | -18,52% |

| 5 Years | 32,62% | 44,13% | -11,51% |

| Launched Jun 2010 | 193,70% | 145,93% | 47,77% |

Cumulative returns based on actual data.

Returns net of commissions.

Past performance is not indicative of future results.

Assumed returns of BH Pigmanort Sicav, merged with the BH Flexible LU fund.

All documentation always up to date

Other funds

you may also be interested in

Our mixed fund that combines our ideas with the greatest potential and conviction.

Our most conservative fixed income fund.

Performance of BH Renta Fija Fija Europa Sicav, merged with the B&H Bonds LU fund.

Performance of Rex Royal Blue Sicav, merged with the B&H Equity LU fund.

Our pension plan to prepare your retirement.